I’ve been extensively using Agenda for the past 1 month, Here is how I use this amazing software for for financial planning.

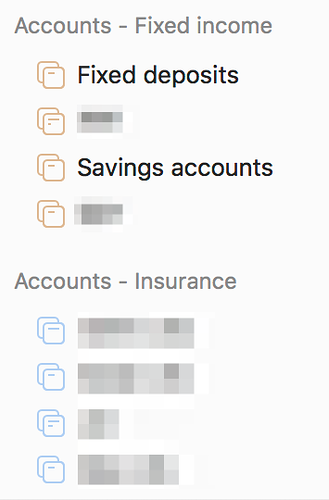

I input my financial goals & accounts as categories, & then add individual projects to each. Ideally, there should be just 2 categories: Goals & Accounts (& then accounts can have sub-categories like fixed income, savings account, mutual funds, insurance, mutual funds, stocks).

![]() ACCOUNTS

ACCOUNTS

Since we yet do not have sub-categories, I create separate categories for each account type, and then add individual account belonging to each category type.

Category: bank accounts

Projects: bank account 1, bank account 2, bank account 3

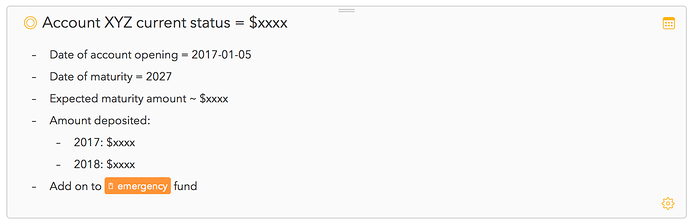

Each account contributes to a specific goal, and more than one account can contribute towards a single goal. e.g. for my retirement, I have monthly investments in mutual fund account, as well as some money in fixed deposits account, as well as some money in stocks account.

Each financial account holds some money, which is linked to a specific goal. So, I use tags (like #retirement, #emergency) inside the accounts, which (via search) give me a broad perspective as to which of my accounts are contributing towards that goal.

![]() GOALS

GOALS

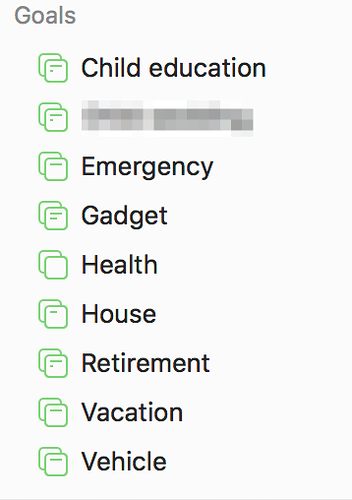

I create a category titled “Goals”, and input all my individual goals as projects inside this category.

e.g.

Category: Goal

Projects: Retirement, Emergency, child education, vacation, vehicle etc.

Each financial goal category has mainly 3 notes:

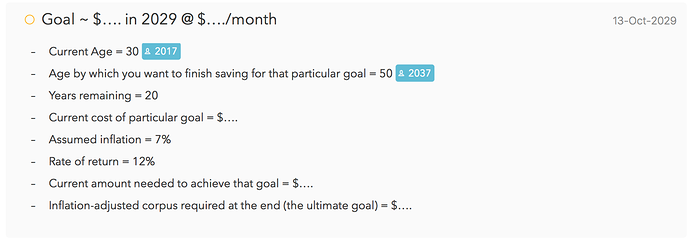

1 - Goal: In financial planning, the following points are important, & I make a note (this would look great as a table) regarding these details for each goal:

I use (misuse?) people tags for quickly adding target years. For example, I have planned my retirement in 2037, so I use the peoples tag as @2037 wherever I refer to that year.

2 - Current status (marked as “on the agenda” for a quick overview as to where I stand). Each goal is (currently) partially met. So, I use links of the accounts (their current valuation is in their title itself) contributing to that goal in a separate note inside that goal.

e.g. Current status = $100

- Mutual fund = $60

- Fixed deposit = $40

3 - Future projections: I have expectations of a particular account reaching a certain value in a certain time. I make a list of all accounts with their expected valuation in the future, and title this note as “Future projections”.

e.g. Future projection = $1000

- Mutual fund = $600 by year 2029

- Fixed deposit = $400 by year 2032

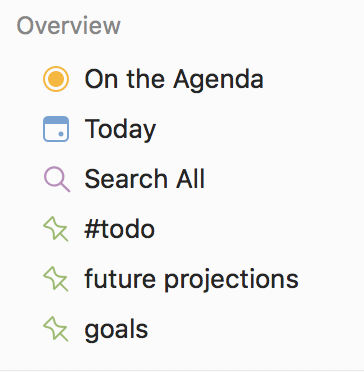

![]() OVERVIEW

OVERVIEW

In the overview section, I use “On the Agenda” for having a bird’s eye view of the current status of my goals. I also use todo tags to quickly see where I need to put my money this month. And I also use saved searches for all goals & their future projections.

Hope all this made some sense. If anybody wishes to use Agenda for financial planning in this way, I can answer queries & would be happy to help.